In the fast-paced world of forex trading, technology continues to push boundaries, and one of the most significant advancements in recent years has been the rise of forex trading robots. These automated trading systems have revolutionized the way traders engage with the forex market, offering new opportunities for both novice and experienced investors. In this article, we will delve into the mechanics of forex trading robots, their benefits, challenges, and how they can be integrated into your trading strategy. Additionally, we will touch upon the role of various brokers, such as forex trading robots Saudi Arabia Brokers, in providing access to these sophisticated tools.

Understanding Forex Trading Robots

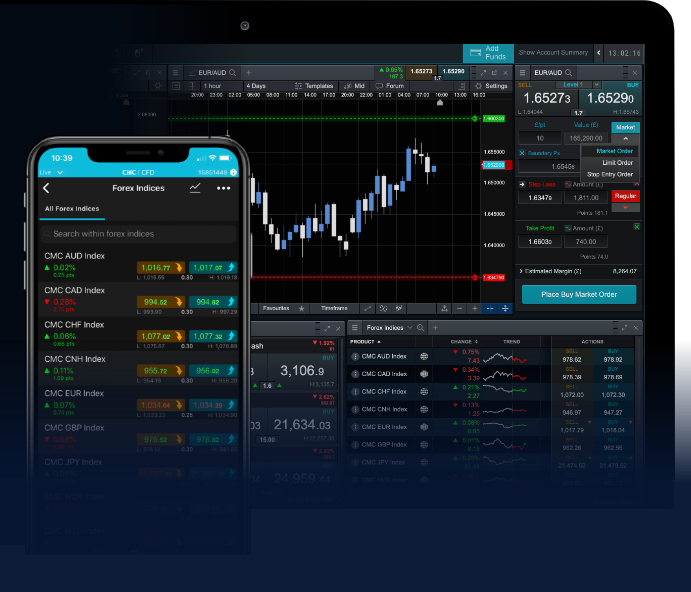

Forex trading robots, also known as Expert Advisors (EAs), are software programs designed to analyze market conditions and execute trades automatically. They operate on algorithms that assess numerous market variables to identify potential trading opportunities. Technically, these robots are built on platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) and can be programmed to follow specific trading strategies.

How Forex Trading Robots Work

At their core, forex trading robots utilize mathematical algorithms to analyze historical data, identify patterns, and make predictions about future market movements. Once these robots are set up with a particular strategy, they can monitor the market continuously, executing trades at any hour of the day or night without the need for human intervention.

Most trading robots can be customized to reflect an individual’s trading style, risk tolerance, and financial goals. Traders can adjust input parameters such as stop-loss and take-profit levels, lot sizes, and other factors to create a risk profile that aligns with their strategy.

Benefits of Using Forex Trading Robots

- Emotionless Trading: One of the substantial advantages of robots is their ability to trade without the emotional influences that often plague human traders, such as fear, greed, and overconfidence.

- Speed and Precision: Trading robots can analyze vast amounts of data and execute trades much faster than a human could, allowing them to capitalize on fleeting market opportunities.

- 24/5 Market Monitoring: EAs can operate around the clock, ensuring that no opportunities are missed due to time constraints or other personal factors.

- Backtesting Capabilities: Traders can test their robots on historical data to gauge their effectiveness before deploying them in live trading scenarios, enabling a more informed approach to risk management.

Challenges and Considerations

Despite the numerous benefits that forex trading robots offer, traders must remain cognizant of certain challenges associated with their use:

- Market Conditions: Trading robots are often designed for specific market conditions. Sudden shifts, such as economic crises or unexpected geopolitical events, can render their strategies ineffective.

- Reliance on Historical Data: Many trading algorithms depend heavily on historical data, which may not always predict future performance accurately.

- Over-optimization: In the pursuit of high returns, traders might over-optimize their robots based on past performance, resulting in models that fail to perform in real-time trading.

- Technical Failures: Software bugs, connectivity issues, or changes in broker policies can disrupt automated trading operations, leading to unforeseen losses.

Integrating Forex Trading Robots into Your Strategy

For traders interested in incorporating forex trading robots into their trading strategy, it’s essential to approach the integration systematically:

Step 1: Research and Selection

Begin by researching various trading robots available in the market. Look for user reviews, performance reports, and backtesting results to select a reliable and reputed robot that aligns with your trading strategy.

Step 2: Backtesting

Before committing real capital, backtest the robot using historical market data. This process allows you to evaluate its performance under various market conditions and adjust parameters to optimize results.

Step 3: Start with a Demo Account

Before trading with real money, it is prudent to use a demo account. This allows for live testing of the robot’s performance without risking your capital, helping you identify any discrepancies or necessary adjustments.

Step 4: Monitor Performance

Even though trading robots can operate autonomously, it’s crucial to monitor their performance periodically. Ensure that they are adapting to market conditions and performing according to your expectations.

Conclusion

Forex trading robots can be a powerful addition to a trader’s toolkit, offering benefits ranging from emotional resilience to 24/5 market responsiveness. However, it is imperative for traders to be aware of the associated challenges and take a structured approach when integrating these tools into their trading strategies. By selecting the right robot, conducting thorough backtests, and continuously monitoring performance, traders can harness the potential of automated trading to achieve better results in the dynamic forex market.

As the financial landscape evolves, the role of advanced trading technologies, including trading robots, will likely continue to expand. Armed with the right knowledge and tools, traders can navigate the complexities of the forex market more effectively and increase their chances of success.